Extension Risk Management Education

"Educating America's farmers and ranchers to manage the unique risks of producing food for the world's table."

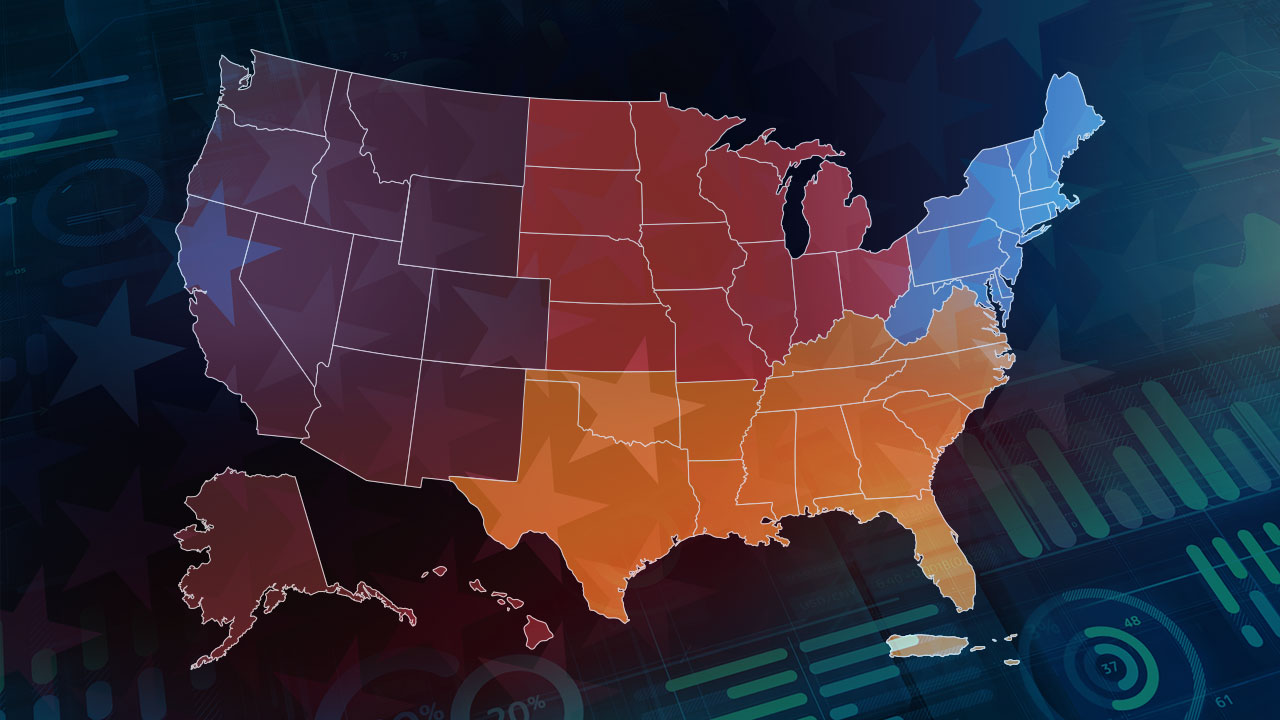

Extension Risk Management Education is delivered through four regional centers that provide grant funding and leadership within their regions.

Projects are producer-focused, outcomes-based and encourage public-private partnerships. Funded projects must identify targeted outcomes that will help producers manage risk and then describe how the project will measure those outcomes.

Extension Risk Management Education has funded innovative programs that have generated tangible outcomes for producers in every state. Commitment to funding outcomes, providing transparent accountability, and encouraging collaboration allow you to view the accomplishments of all funded projects on this website.

Western Center

North Central Center

Northeast Center

Southern Center

What is Risk Management?

Risk Management involves choosing among various risk management strategies and tools designed to reduce the financial effects of the uncertainties of weather, yields, prices, government policies, global economies, human factors, and other conditions that can cause dramatic fluctuations in farm income.

Risk Management Education provides training that improves the ability of agricultural producers and their families to effectively manage risk. Training addresses five general types of risk associated with farm and ranch businesses:

- Production Risk is a result of uncertain natural growth processes of crops and livestock. Weather, disease, pests, and other factors affect both the quantity and quality of commodities produced.

- Price or Market Risk is created by the variability of prices producers receive for their production, the access they have to markets for their products, and the prices and the availability of inputs.

- Financial Risk occurs due to the capital-intensive nature of farming and ranching businesses. Volatility of prices, yields and income impact the debt-repayment ability and a business’s cash liquidity. Changing interest rates, credit rules, and the availability of credit are also aspects of financial risk. Financial risk is often intensified by the lack of detailed financial analysis and planning.

- Legal/Institutional Risk is generated by uncertainties surrounding and resulting from government policies and regulations related to tax laws, food safety, labeling and marketing, protected species, water use, animal health and welfare, chemical use, animal waste, other environmental issues such as clean air and water, government commodity and income support programs, and the legal liabilities of a variety of litigious issues faced by farms and ranches.

- Human Risk refers to human relationships that impact the viability of farm and ranch businesses including communication, labor management and supply, business succession and intergenerational transfer of assets and management, estate planning, and human health and relationship issues including accidents, illness, disability, death and divorce.